Getting started in property investment in Australia? It’s one of the most powerful ways to build long-term wealth — but only if you avoid the common traps.

With so much noise in the real estate market, first-time property investors often make missteps that cost time, money, and momentum. Here are the top three we see — and how you can avoid them.

1. Chasing Quick Profits Instead of Long-Term Growth

The dream of buying, flipping, and pocketing instant cash is tempting — but it’s not the norm. In reality, most success stories in the Australian property market come from strategic, long-term investment.

The Australian market favours smart investors who focus on sustainable growth, high rental yields, and suburbs with infrastructure and population growth potential.

Playing the long game delivers real estate investment returns that last.

2. Failing to Research the Suburb and Builder

Buying based on flashy marketing or a friend’s tip can backfire fast. Without deep real estate research into the suburb and builder, you’re risking your entire investment.

Ask the right questions:

Is the suburb backed by infrastructure development or just hype?

What are the local vacancy rates and rental yields?

Is the property developer or builder reputable, with a track record in Australia’s real estate market?

Doing this groundwork — or working with a trusted property team like GHR Realty, who already knows the Australian real estate landscape — can save you from expensive investor mistakes.

3. Buying with Emotion Instead of Strategy

This is one of the most common pitfalls. Many first-time real estate investors choose a property based on what they like — not what the market demands.

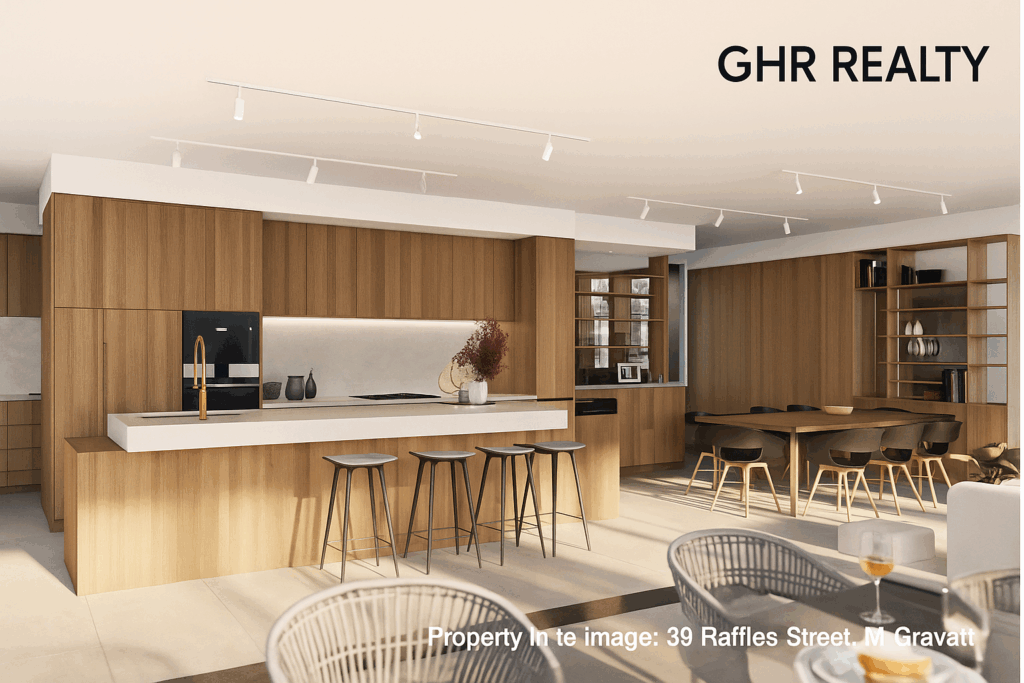

A stylish kitchen or a property that “feels right” doesn’t guarantee positive cash flow or capital appreciation.

Property investment isn’t about personal taste — it’s about ROI, data, and future growth. Treat your investment like a business.

Focus on:

Rental demand

Public transport access

School catchments

Local infrastructure

Area demographic

The Bottom Line

Real estate investing in Australia is one of the most secure and rewarding wealth-building vehicles — but only if done smartly.

At GHR Realty, we guide first-time buyers and property investors every step of the way, from identifying investment opportunities to navigating contracts and providing post-settlement support.

We remove the guesswork and give you the strategy to succeed.

👉 Visit www.ghr-realty.com/property to explore our current listings or book your free investment consultation.

Let’s make your first investment not just a property, but a powerful start to your real estate journey.

📩 Email: Soundarya@ghr-realty.com

🌐 Website: www.ghr-realty.com

Trusted by clients across Australia and internationally.

Opportunity doesn’t wait. Neither should you. Let’s talk strategy today.